401(k) Target-Date Fund Basics

Target-Date Fund Basics

Investing for retirement can be daunting, but target-date funds can make it easier for investors to manage their portfolios. As a result, these funds are becoming increasingly popular in 401(k) plans. This blog post will closely examine target-date funds and how they work.

What is a Target-Date Fund?

Target-date funds invest in a diversified portfolio of stocks, bonds, and other asset classes to reach a specific retirement date. They automatically adjust the asset allocation mix as an investor approaches retirement, becoming more conservative.

For example, if someone anticipates retiring at age 65 and their 65th birthday is in the year 2050, they may choose a target 2050 fund. A target-date fund with a target date of 2050 will typically have a more aggressive asset allocation, with a higher percentage of stocks and other growth-oriented assets, than a fund with a target date of 2030. However, as the target date approaches, the fund will gradually shift its asset allocation to a more conservative mix of bonds and other fixed-income investments.

What is a Target-Dates Fund's Glide Path?

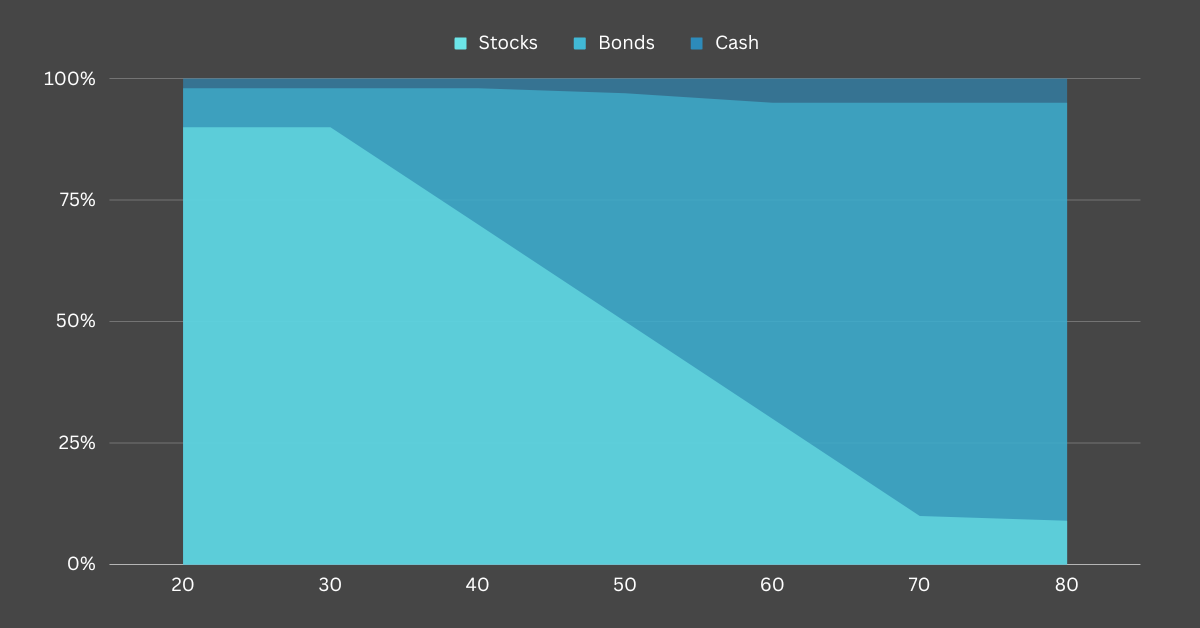

The rate at which a target-date fund moves from a more aggressive allocation to a more conservative one is called a glide path. Some glide paths move to a conservative asset allocation quicker than others. Different fund providers have different glide paths.

Target-date funds can follow two main types of glide paths: "to" glide paths and "through" glide paths. Let's take a closer look at each type.

Here is an example of what a glide path might look like.

"To" Glide Paths

A "to" glide path is the traditional target-date fund asset allocation approach. Target-date funds that use a "to" glide path move from a more aggressive allocation to a less aggressive percentage up to retirement. At that point, the asset allocation remains static at a specific level of aggressive to conservative investments.

For example, the fund may reach 10% stock and 90% bonds and cash at retirement. At that point, the fund keeps that allocation static.

"Through" Glide Paths

A "through" glide path strategy assumes that an investor will remain invested in the target-date fund even after retirement instead of selling all assets at retirement. Thus, the asset allocation mix will continue to adjust through retirement.

Which Glide Path is Better?

There is no right or wrong answer to which glide path strategy is better, as each design has advantages and disadvantages. For example, a "to" glide path may be more appropriate for investors who plan to move out of the plan at retirement. On the other hand, a "through" glide path may be more suitable for investors who plan to remain invested in the target-date fund after retirement and want a more aggressive mix of investments.

Why are Target-Date Funds Popular in 401(k) Plans?

Target-date funds are popular in 401(k) plans because they provide a simple and convenient way for investors to manage their portfolios. Rather than constantly monitoring and adjusting their asset allocation mix, investors can choose a target-date fund corresponding to their expected retirement date and let the fund manager do the work.

Qualified Default Investment Alternative (QDIA)

In addition to their simplicity, target-date funds can qualify as a Qualified Default Investment Alternative (QDIA). A Qualified Default Investment Alternative is not required, but it can reduce the liabilities of the plan's investment fiduciaries. Reducing investment liabilities is accomplished by meeting the safe harbor requirements under ERISA section 404(c).

Under this safe harbor, participants will self-direct their investment choices and be responsible for their investment decisions in the 401(k) plan if conditions are met. Passing the investment decisions responsibilities to participants does not take plan investment fiduciaries off the hook for the fund menu provided.

What are the advantages of investing in target-date funds?

There are several advantages to investing in target-date funds. Here are a few benefits to target-date funds.

Diversification

Target-date funds typically invest in a diversified portfolio of stocks, bonds, and other asset classes, which can help reduce the risk of investment losses. This automatic diversification takes much of the investment selection burden off the shoulders of the participant. In addition, this automatic diversification is helpful because it allows the average investor to have an age-appropriate investment allocation managed for them.

Automatic Rebalancing

Recordkeeping platforms generally have automatic rebalancing capabilities for investors regardless of whether they are in a target-date fund. What makes target-date funds unique is their automatic rebalancing of asset allocation. As an investor approaches retirement, the target-date fund will adjust the asset allocation mix to become more conservative, reducing the risk of significant losses.

Convenience

Unfortunately, it is not uncommon for potential 401(k) participants to avoid joining the plan due to a lack of investment knowledge. Target-date funds are easy to use and require minimal effort from the investor. Knowing there is a turnkey approach can help employees feel more comfortable investing in a 401(k) plan.

Professional Management

Choosing a high-quality target-date fund series can bring the experience and resources of the investment company overseeing the fund.

Drawbacks of Investing in Target-Date Funds

While target-date funds have many advantages, they have their drawbacks. Some potential disadvantages include the following.

Lack of Customization

While target-date funds offer some customization based on retirement dates, they generally don't consider an investor's risk tolerance or other personal factors. Some investment providers have target-date funds designed to allow participants to choose an aggressive, moderate, or conservative version of the target-date fund.

Fees

Target-date funds may charge higher fees than other investment options due to the need for reallocating funds through an investor's retirement cycle. As a result, costs can eat into investment returns over time. Some providers offer index options with passive investment management and lower costs.

Limited Control

Investors in target-date funds may need more control over the asset allocation mix and investment decisions. Target-date funds may not be suitable for those who want more control over their investments.

Also, keep in mind that not all target-date funds are created equal. For example, two funds may have a 60/40 stock-to-bond allocation, but that does not mean they have the same type of stocks and bonds. Some funds have more aggressive stocks or bonds.

No Guarantee

Target-date funds are not guaranteed to provide a specific level of return, and investors may still experience losses if the market performs poorly. There is also no guarantee that an individual can retire at the age listed as the target date.

Conclusion

Target-date funds are a popular investment option in 401(k) plans because they provide a convenient way for investors to manage their portfolios. However, while they have many advantages, investors should also be aware of the potential drawbacks and carefully consider their investment goals and risk tolerance before choosing a target-date fund.

Please set up a consultation if you need help reviewing your 401(k) plan. Though CUI Wealth Management is in Salt Lake City, Utah, we serve clients in many states. Please see the website footer for a complete list of states we serve.

Disclosures

Mutual funds are sold by prospectus only. Before investing, investors should carefully consider the investment objectives, risks, charges and expenses of a mutual fund. The fund prospectus provides this and other important information. Please contact your representative or the Company to obtain a prospectus. Please read the prospectus carefully before investing or sending money. There are some specific traits of target date funds that you need to be aware of. Target-date funds are not guaranteed against losses. Funds with similar target dates can transition to more conservative investments in different ways and at different times. Combining target-date funds with other investments affects your overall asset allocation. Reaching the target date does not mean you’ve saved enough to meet your goal. Pick your target date carefully. Assess how much risk you are willing to take. Determine whether the fund will take you to or through retirement. Monitor the glide path of your target-date fund. Pay attention if automatically enrolled. Keep your "mixed" investments balanced. Investing involves risk. Loss, including loss of principal may occur. No investment strategy can guarantee positive results, nor can it protect against loss in periods of declining markets. Past performance does not guarantee future results.